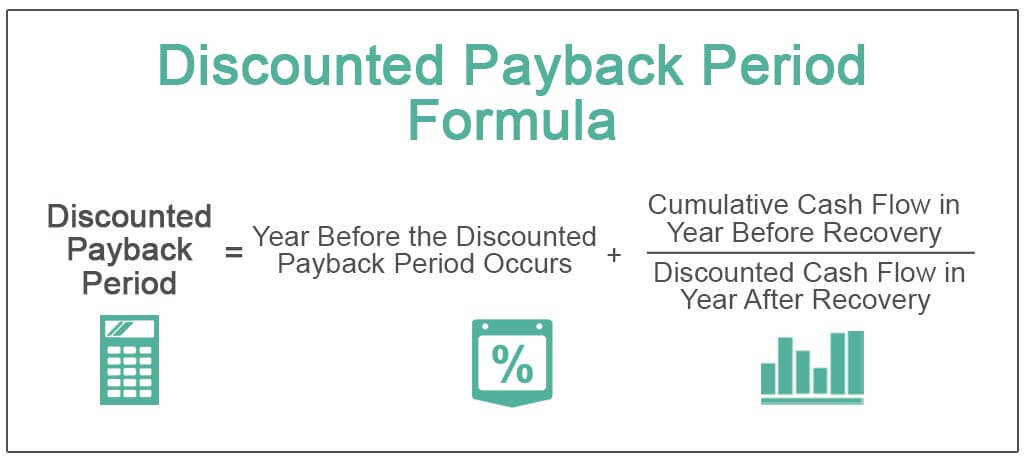

Discounted Payback Period Formula

Here we discuss the top advantages disadvantages of the payback period along with examples and explanations. Arr npv irr pbp discounted pvb.

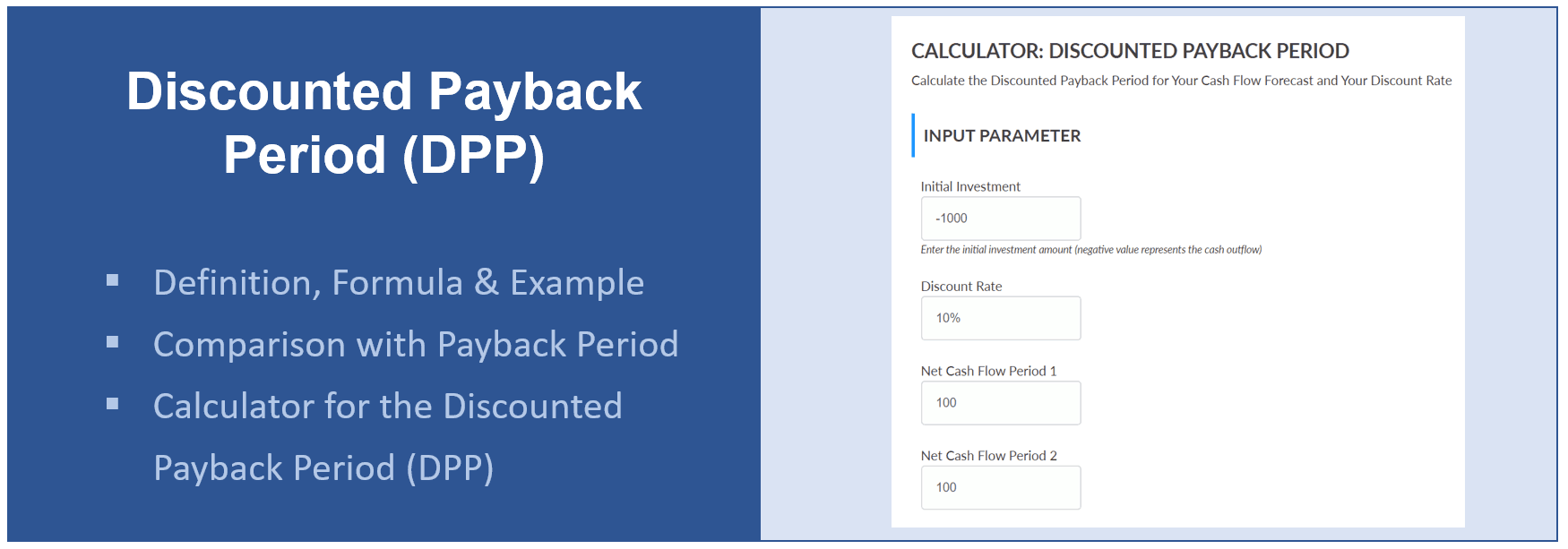

Discounted Payback Period Formula And Calculator Excel Template

A project costs 2Mn and yields a profit of 30000 after depreciation of 10 straight line but before tax of.

. Read what are Discounted Cash Flows to get a clear understanding of DCF techniques. The return that could be earned per unit of time on an investment with similar risk is the net cash flow ie. A variation on the payback period formula known as the discounted payback formula eliminates this concern by incorporating the time value of money into the calculation.

The payback period is similar to a breakeven analysis but instead of the number of units to cover fixed costs it looks at the amount of time required to return the investment. Ogni azienda o privato deve infatti prendere delle decisioni dinvestimento dirette ad allocare i soli progetti che creano valore tenendo conto delle limitate risorse disponibili fattori produttiviPer poter risolvere a sistema tale problema di scelta fra. The discounted payback period is a capital budgeting procedure used to determine the profitability of a project.

If a 100 investment has an annual payback of 20 and. A discounted payback period gives the number of years it. The last metric to calculate for a capital investment is the payback period which is the total time it takes for a business to recoup its investment.

This disadvantage is countered by the discounted payback period formula. Payback period Investment required Net annual cash inflow c The. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

Depreciation is provided on straight line methodcost of capital is 22 required. ARRAverage annual profit after tax Initial investment X 100. Let us see an example of how to calculate the payback period when cash flows are uniform over using the full life of the asset.

Starting from Year 1 to Year 5 we can see an increase from 112 to 150 which is caused by the increased profit margins and the increase in operating current. Between mutually exclusive projects having similar return the decision should be to invest in the project having the shortest payback period. The payback period of a given investment or project is an important determinant of whether.

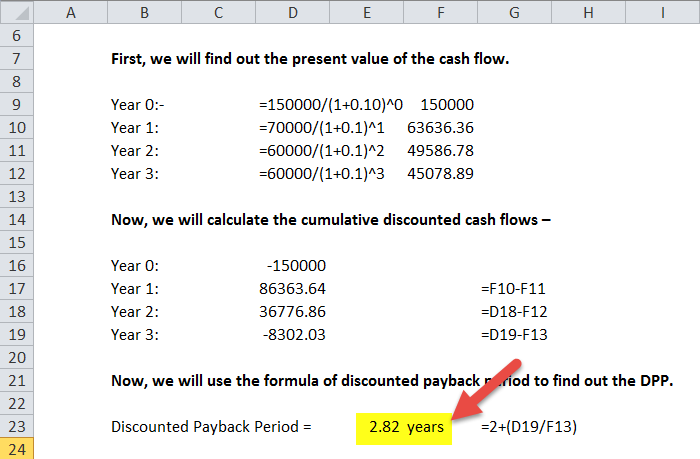

Discounted Payback Period Discounted payback period is the time taken to recover the initial cost of investment but it is calculated by discounting all the future cash flows. The payback period is the length of time required to recover the cost of an investment. Payback period Formula Total initial capital investment Expected annual after-tax cash inflow.

10mm Cash Flows Per Year. The payback period formula. Considering that the money going out is subtracted from the discounted sum of cash flows coming in the net present value would need to be positive in order to be considered a valuable investment.

Each cash inflowoutflow is discounted back to its present value PV. Where is the time of the cash flow is the discount rate ie. Cash inflow cash outflow at time t.

5 Payback Period. When discounted cash flow methods of capital budgeting are used the working capital required for a project is ordinarily counted as a cash outflow at the beginning of the project and as a cash inflow at the end of the project. The longer the payback period of a project the higher the risk.

This method of calculation does take the time value of money into the account. Il problema che viene affrontato dalla valutazione degli investimenti è nella sostanza un problema di scelta. Accounting rate of return method.

First well calculate the metric under the non-discounted approach using the two assumptions below. Other capital budgeting analysis methods that include the time value of money are the net present value method and the internal rate of return. Once the entire forecast has been filled we can calculate the ROIC in each period by dividing NOPAT by the average between the current and prior period invested capital balance.

Of N200000 for a period of 5 yrs. Cash flow per year ln1 discount rate The following is an example of determining discounted payback period using the same example as used for determining payback period. This has been a guide to Payback Period Advantages and Disadvantages.

The formula for the payback period is. 4mm Our table lists each of the years in the rows and then has three columns. Then all are summed such that NPV is the sum of all terms.

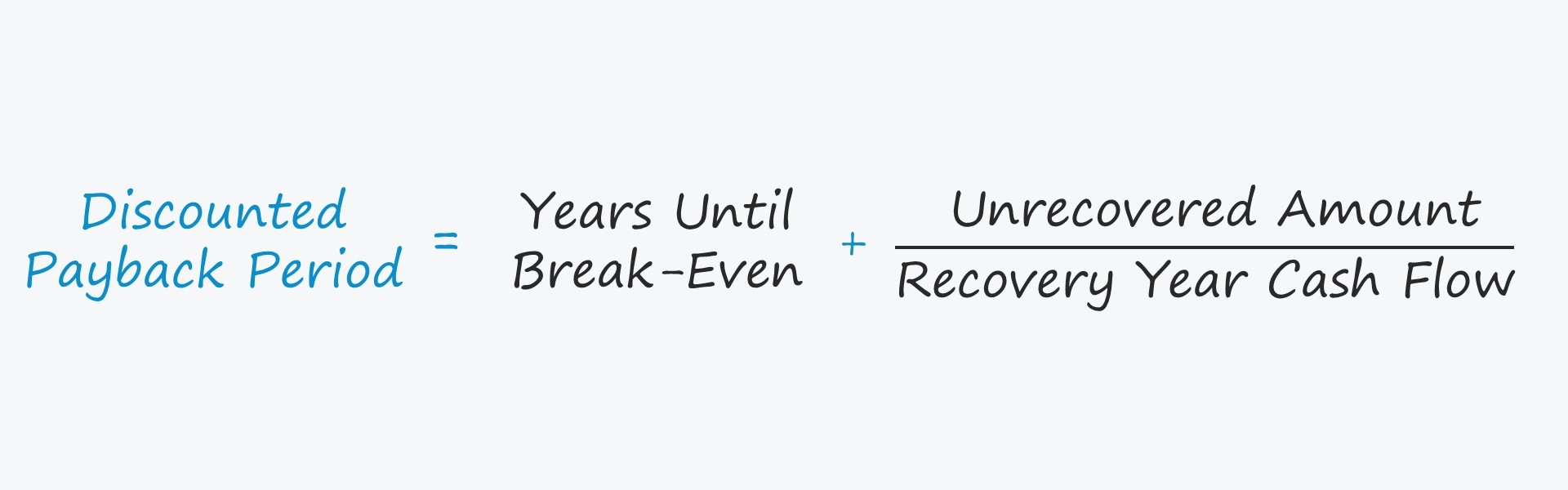

The formula for discounted payback period is. You can learn more about financial analysis from the following articles Dollar-Cost Averaging. When deciding whether to invest in a project or when comparing projects having different.

In the formula the -C 0 is the initial investment which is a negative cash flow showing that money is going out as opposed to coming in. Payback Period 3 1119 3 058 36 years. Formula of Discounted Payback Period.

Discounted Payback Period. Discounted Payback Period - ln1 - investment amount discount rate. The expected scrap value is 56000.

Payback Period Example Calculation. It is the most popular method of investment appraisal. Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you.

The formula of ARR is as follows. The formula is given below.

Discounted Payback Period Formula With Calculator

Discounted Payback Period Definition Formula Example Calculator Project Management Info

No comments for "Discounted Payback Period Formula"

Post a Comment